If you’re looking to borrow money to cover business or personal requirements, it’s important to carefully consider interest rates, the terms of your lender as well as the overall financial implications. Within these variables they play the biggest factor in determining the costs of credit and loans. Understanding how prime rates function can help you get better deals on financial products, whether you are applying for business loans or a personalized credit card.

The prime rate for loans is often used by many lenders to calculate interest rates. PrimeRates makes this easier by offering loan deals that are tailored to your needs and providing transparency.

What is Prime Rate and how does it Work?

The prime rate is the rate of interest that financial institutions charge their clients with the highest credit ratings generally large corporations. The Federal Reserve sets the federal funds rate. When the Federal Reserve raises or lowers interest rates, the loan’s prime rate is adjusted accordingly.

For the borrower, this rate is essential because it serves as the base for many loan products. In general, lenders include a margin on the prime rate, based on the applicant’s creditworthiness. People with good credit histories get rates that are closer to the prime rate, while those with less favorable credit scores may be offered higher interest rates in order to make up for the risk associated with lending.

Prime Rates and Business Loans

The ability to secure a business loan that is tailored to your needs is usually essential to fund expansion, purchasing inventory or managing cash flow. The price of borrowing however, is directly connected to the prime rate. It is crucial to be aware of the impact of prime rates prior to committing to any loan.

Lower prime rates equal lower borrowing costs – when the prime rate falls, business loans are much more affordable. In this way, borrowers can obtain loans at lower interest rates which is the perfect opportunity to invest in the development of their company.

Higher Loan Rates Increase Borrowing Costs – As the prime rate of a loan grows, borrowing costs increase. The increased monthly payments could negatively impact the company’s cash flow. Financial stability can be maintained by preparing ahead for changes in interest rates.

The credit score affects loan terms. While the prime rate serves as the benchmark used to determine the terms of loans, it varies on a borrower’s credit profile. Businesses with a good financial record get better rates. However, those with low credit scores will need to find alternative financing.

Prequalification could help ensure better loan Offers – Instead of applying blindly, and then facing rejection, borrowers can profit from prequalification software that matches them with lenders based on financial standing. This lets you get a better understanding of the rates that may be offered before you submit a loan request.

PrimeRates can help you locate the perfect loan.

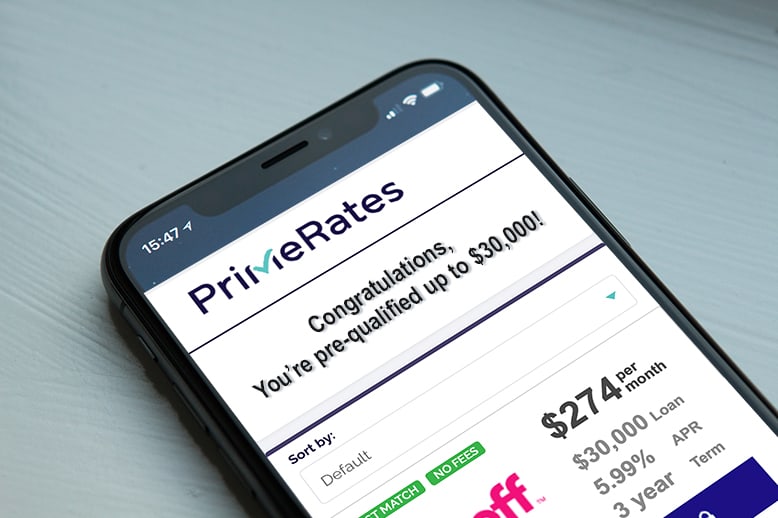

Comparing the offers of loans and understanding lending terms can be an exhausting process. PrimeRates provides a platform on which consumers can access tailored business loans, without affecting their credit score.

Simple Pre-Qualification: By providing basic financial information, applicants receive prequalified choices that are specifically tailored to their needs.

Transparent Rate Comparisons – Instead making assumptions about which rates apply Borrowers can view rates that are based on actual rates.

Secure and Reliable Loan Options Secure and Reliable Loan Option Lender partnerships give access to flexible terms, attractive rates and secured loans.

The Prime Rate and Business Loans Final Remaining

Understanding prime rates are essential to apply for loans. This is the case whether you need to borrow money for business expansion or for managing expenses. A lower prime rate on loans means more affordable borrowing options as a rising prime rate could impact the financial planning.

Instead of unsure Borrowers have the option to use platforms that provide specific information on rate and eligibility for loans. Exploring personalized business loans through transparent lenders ensures access to financing solutions that align with financial goals.